Rumored Buzz on Online Payment Solutions

Wiki Article

Rumored Buzz on Payeezy Gateway

Table of ContentsThe 6-Minute Rule for Credit Card Processing FeesThe Main Principles Of Ebpp How First Data Merchant Services can Save You Time, Stress, and Money.Getting The Credit Card Processing Fees To WorkAn Unbiased View of Payeezy Gateway3 Easy Facts About Payment Hub ShownThe Facts About Comdata Payment Solutions UncoveredThe Clover Go PDFsThe Single Strategy To Use For Credit Card Processing Fees

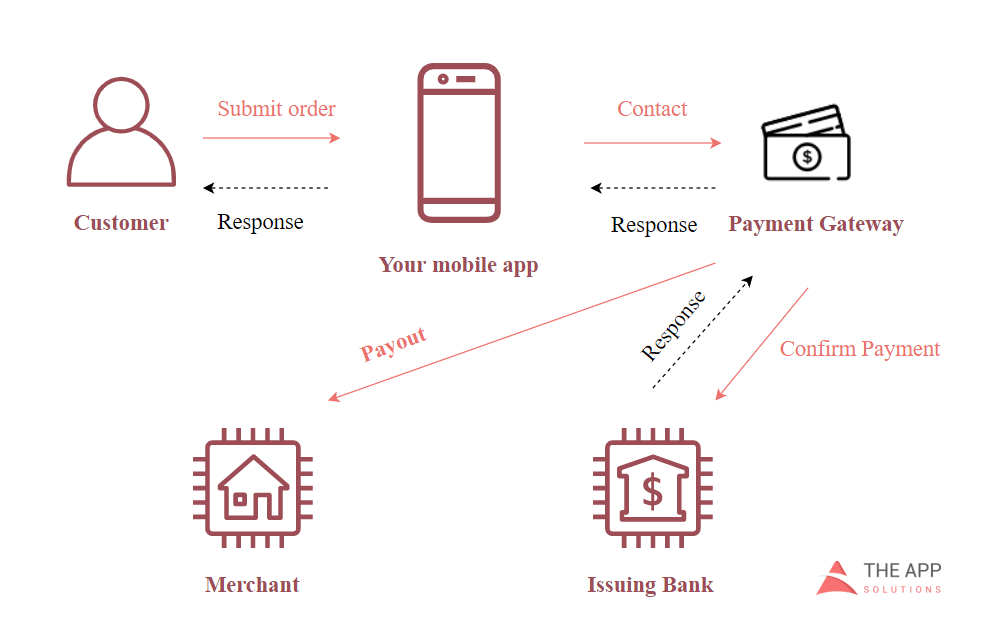

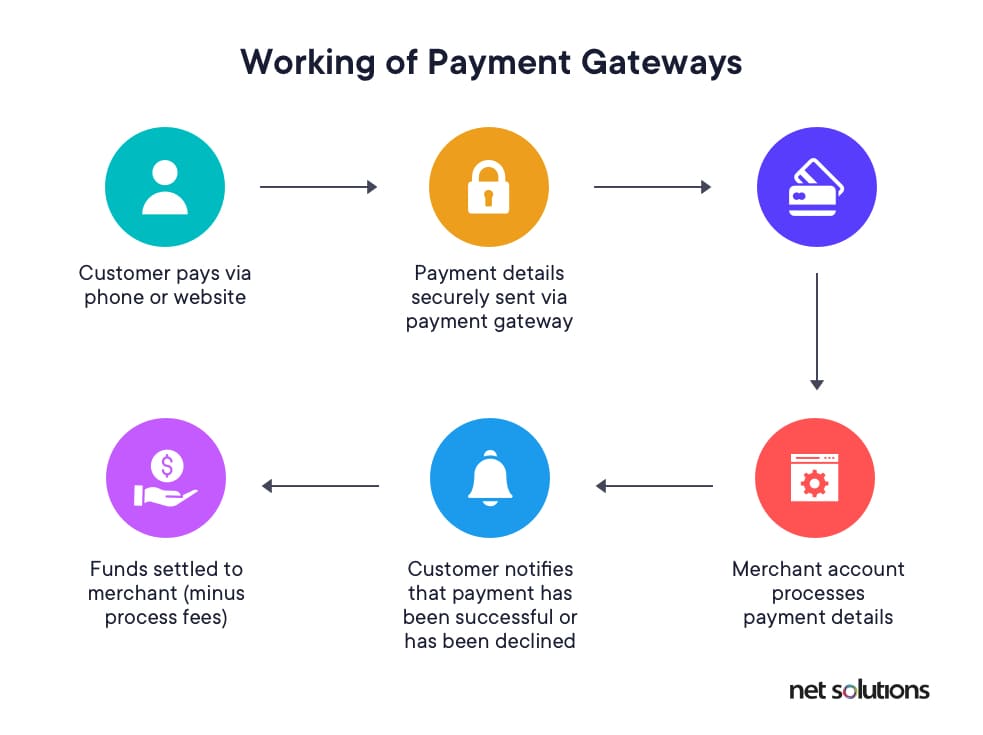

The most common problem for a chargeback is that the cardholder can not keep in mind the deal. However, the chargeback proportion is extremely low for transactions in a face-to-face (POS) environment. See Chargeback Management.You don't require to come to be a professional, yet you'll be a far better customer if you understand just how charge card handling in fact works. To recognize exactly how the payment process works, we'll look at the stars and also their duties. Who are the stars in a credit score and also debit card deals? gets a debt or debit card from an uses the account to pay for products or services.

The Main Principles Of Credit Card Processing Fees

That's the debt card procedure in a nutshell. The fees the account for the quantity of the transactions. The after that transfers suitable funds for the deals to the, minus interchange charges.

Rumored Buzz on Virtual Terminal

You can get a vendor account via a repayment handling company, an independent contractor, or a large bank. A payment processing firm or financial institution handles the deals in between your customers' banks and also your bank.You must permit sellers to gain access to info from the backend so they can check out background of repayments, cancellations, and other purchase information. Also, you have to adhere to the PCI Security Standards to supply internet site payment processing solutions for consumers. PCI Protection assists suppliers, merchants, as well as banks execute standards for producing protected payment solutions.

Examine This Report on Virtual Terminal

Various other downsides include high rates for some types of settlement handling, restrictions on the number of purchases per day as well as quantity per deal, and also protection holes. There's likewise a selection of on the internet repayment handling software program (i.

merchant accounts, sometimes with often payment gateway)Portal An additional choice is an open resource payment processing system.

Getting The Online Payment Solutions To Work

They can also make your cash money circulation much more predictable, which is something that every local business proprietor strives for. Learn more how around B2B repayments work, and also which are the very best B2B settlement items for your small organization. B2B repayments are settlements made in between two merchants for goods or services.

Not known Details About Online Payment Solutions

People involved: There are numerous people included with each B2B deal, including accounts receivable, accounts payable, invoicing, as well as procurement groups. Payment delay: When you pay a friend or relative for something, it's often ideal on-site (e. g. at the dining establishment if you're splitting a costs) or just a couple of hrs after the event.In light of the intricacy of B2B repayments, even more as well as a lot more services are choosing for trackable, digital repayment choices. There are 5 main ways to send out and receive B2B settlements: Checks This category includes conventional paper checks and also electronic checks issued by a purchaser to a vendor.

7 Easy Facts About Payment Solutions Described

Wire transfers description These are funds transfers between banks that are routed through an economic network like SWIFT. Cord transfers usually supply cash within hrs. Digital bank transfers These are repayments between banks that are transmitted via the Automated Cleaning Home (ACH). This is just one of the most safe and also trustworthy payment systems, however financial institution transfers take a few days longer than cord transfers.Each choice differs in simplicity of usage for the sender and also recipient, expense, and safety. That claimed, many services are changing away from paper checks as well as relocating toward electronic and also electronic settlements.

official site

The Greatest Guide To Virtual Terminal

Payments software and apps have reports that give you a review of your balance dues and also accounts payable. As an example, if there a couple of vendors that on a check regular basis pay you late, you can either apply stricter deadlines or stop working with them. B2B repayment remedies also make it simpler for your consumers to pay you, aiding you receive settlement much faster.Report this wiki page